Welcome to

On Feet Nation

Blog Posts

Stone Island 正品怎麼看?台灣專櫃教戰「防偽標 / 洗標」辨別

Posted by 时尚潮人 on February 18, 2025 at 8:25pm 0 Comments 0 Likes

1. 防偽標的辨別

1.1 袖標細節

小資族也買得起!Stone Island 高 CP 值「入門 5 大神款」推薦清單

Posted by 时尚潮人 on February 18, 2025 at 8:25pm 0 Comments 0 Likes

1. 連帽衫

Astrological Tastes: The World of Tara Yummy Zodiac

Posted by freeamfva on February 18, 2025 at 8:18pm 0 Comments 0 Likes

متجر Marble Store للكوكيز

Posted by mahraja jack on February 18, 2025 at 7:15pm 0 Comments 0 Likes

إذا كنت من عشاق الكوكيز وترغب في تجربة نكهات مبتكرة وجودة عالية، فإن Marble Store هو وجهتك المثالية. يتميز هذا المتجر بتقديم مجموعة متنوعة من نكهات الكوكيز التي تناسب جميع الأذواق، مع إمكانية تخصيص الطلبات وفقًا لرغبة العملاء، مما يجعله خيارًا مثاليًا لمحبي الحلويات.

تشكيلة واسعة من النكهات

يقدم Marble Store تشكيلة واسعة من الكوكيز بنكهات مختلفة، بدءًا من الشوكولاتة الداكنة والمكسرات، وصولًا إلى نكهات أكثر جرأة مثل…

Top Content

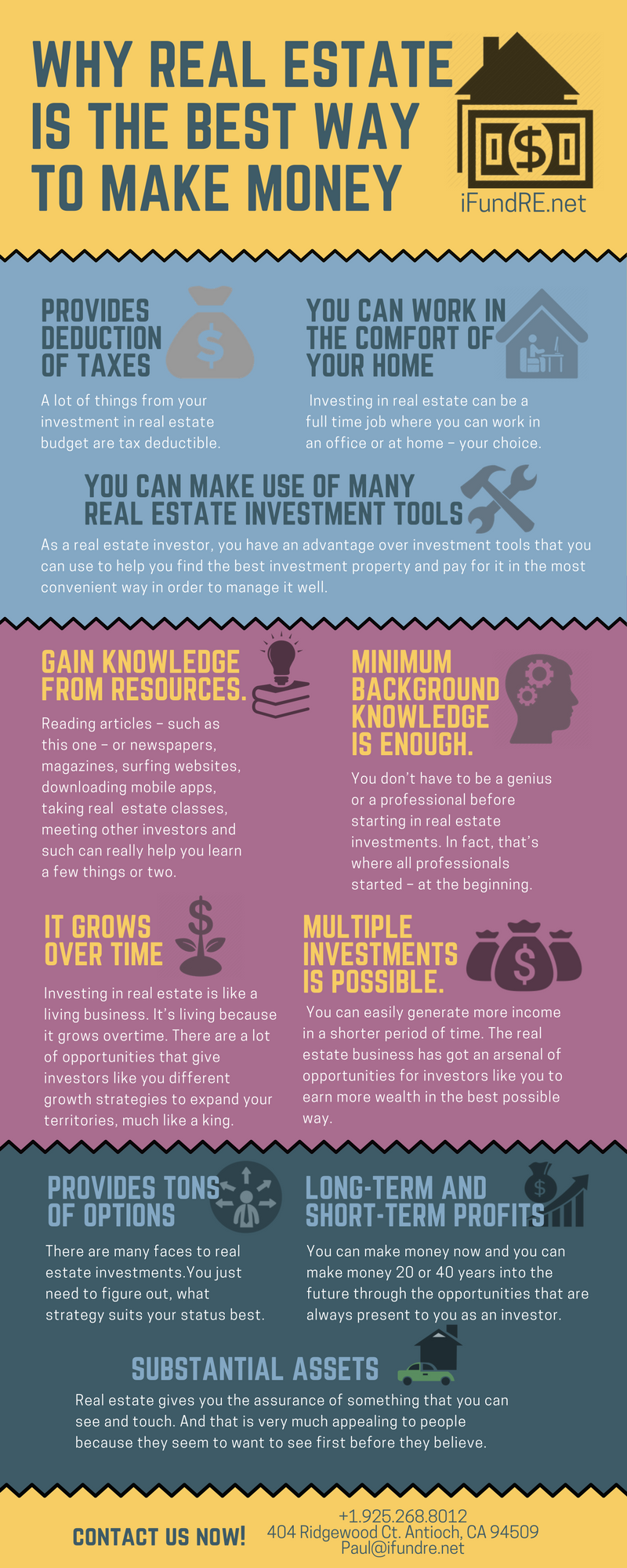

How To Get Started In Real Estate for Dummies

Shop around. Do not settle for the first loan provider that pre-approves you for a home loan, as you might pay more than you ought to in interest and home mortgage insurance coverage. You need to compare at least three different lending institutions before making a decision. Attempt to increase your deposit to a minimum of 20 percent in order to Great post to read lower your monthly payments in the long run. Or, you might acquire a less costly house. Think about other types of loans. Yes, standard loans are the most popular however there are lots of other options, such as FHA and VA loans that might be much better for you. How to become a real estate developer. To read more about PMI and other requirements of financing a house, contact the professionals at Berkshire Hathaway.

Personal mortgage insurance (PMI) protects the loan provider in case you default on your mortgage payments and your house isn't worth enough to totally pay back the lending institution through a foreclosure sale. Regrettably, you bear the cost for the premiums, and lenders generally need PMI for loans where the down payment is less than 20%. They include the expense to your home loan payment monthly, in a quantity based upon just how Have a peek here much you have actually obtained. The bright side is that PMI can normally be canceled after your home's worth has actually increased enough to provide you 20% to 25% equity in your house.

The Act says that you can ask that your PMI be canceled when you've paid down your mortgage to 80% of the loan, if you have a good record of payment and compliance with the terms of your mortgage, you make a composed request, and you show that the value of the property hasn't decreased, nor have you encumbered it with liens (such as a second home mortgage). If you fulfill all these conditions, the lender needs to give your demand to cancel the PMI. What's more, when you have actually paid for your home loan to 78% of the initial loan, the law says that the lending institution needs to instantly cancel your PMI.

Regrettably, it might take years to get to this point. Thanks to the marvels of amortization, your schedule of payments is front-loaded so that you're mostly paying off the interest at first. Even if you haven't paid for your home mortgage to one of these legal limits, you can start attempting to get your PMI canceled as quickly as you think that your equity in your house or your home's value has actually increased substantially, maybe due to the fact that your house's worth has actually risen in addition to other local homes or due to the fact that you have actually redesigned. Such value-based increases in equity are harder to prove to your lending institution, and some lenders need you to wait a minimum time (around two years) before they will authorize cancellation of PMI on this basis.

You'll probably need to: It's best to write a letter to your mortgage loan provider, formally requesting standards. Your loan provider might require an appraisal even if you're requesting a cancellation based on your lots of payments, given that the lender needs reassurance that the house hasn't decreased in worth. Although you'll typically pay the appraiser's bill, it's finest to utilize an appraiser whom your lender advises and whose findings the lending institution will therefore appreciate. (Note: Your tax evaluation may show a completely different worth from the appraiser's-- do not be worried, tax evaluations frequently lag behind, and the tax assessor will not see the appraiser's report, thank goodness.) This is a simple computation-- simply divide your loan amount by your house's value, to get a figure that needs to be in decimal points.

8, or 80%. Most lenders need that your LTV ratio be 80% or lower prior to they will cancel your PMI. Keep in mind: Some lending institutions express the percentage in reverse, needing at least 20% equity in the residential or commercial property, for example. When your LTV ratio reaches 78% based on the initial value of your house, bear in mind that the Property owners' Protection Act may need your loan provider to cancel your PMI without your asking. If the loan to value ratio is at the portion required by your lender, follow the loan provider's stated procedures for asking for a PMI cancellation. Anticipate to have to write another letter with your demand, mentioning your home's present worth and your remaining debt amount, and consisting of a copy of the appraisal report.

Nonetheless, lots of house buyers discover their loan providers to be frustratingly sluggish to awaken and cancel the coverage. The reality that they'll need to invest time evaluating your declare no instant gain and that the insurance coverage business may likewise drag its feet are probably contributing elements. If your lender http://claytonokrv916.fotosdefrases.com/everything-about-how-to-bec... refuses, or is slow to act upon your PMI cancellation demand, compose polite however firm letters requesting action. How to get a real estate license in oregon. Such letters are essential not only to prod the lending institution into movement, however to function as evidence if you're later required to take the loan provider to court. You can likewise submit a problem online to the Customer Finance Security Bureau (CFPB).

© 2025 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation